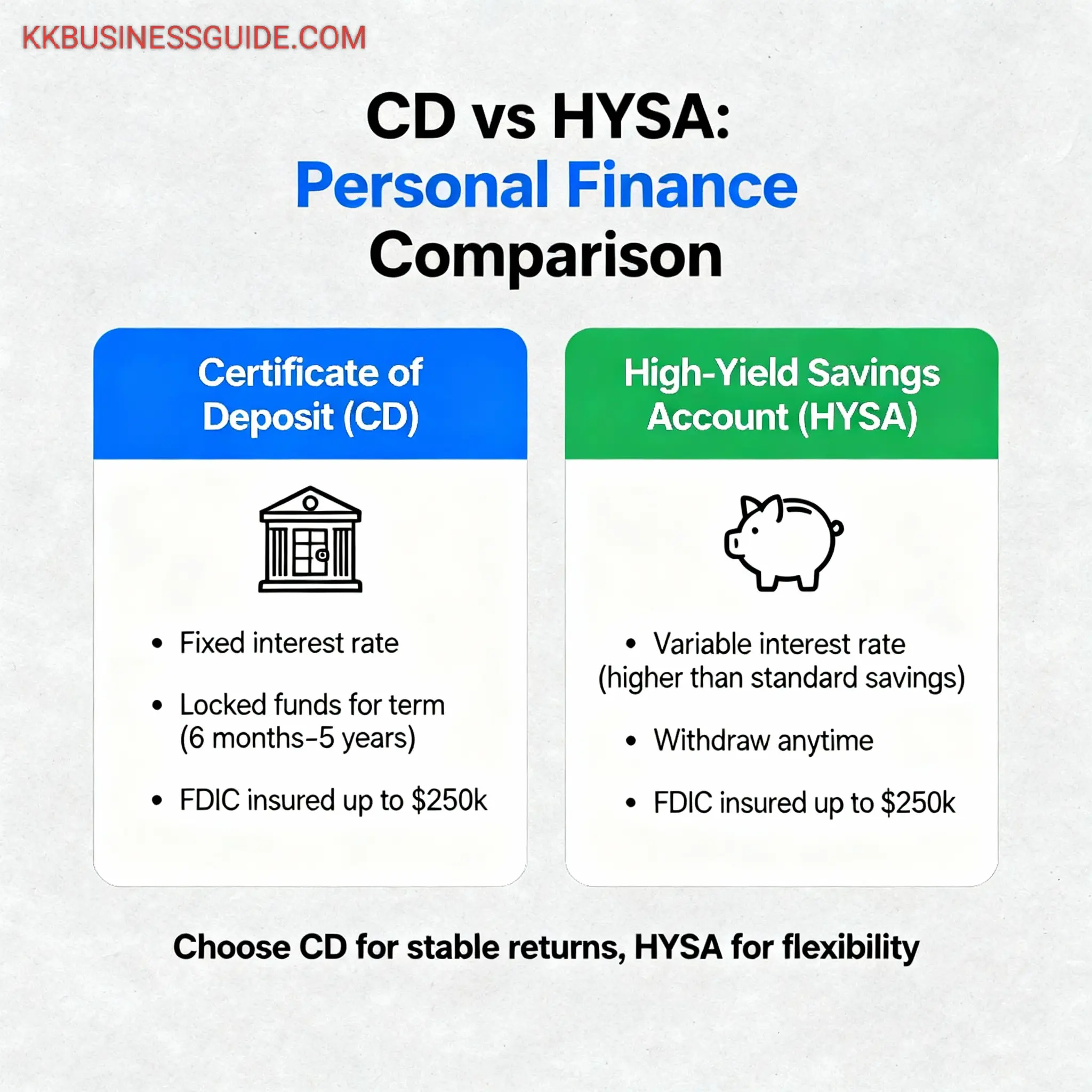

When it comes to saving money, people often get confused between two popular options: Certificates of Deposit (CDs) and High-Yield Savings Accounts (HYSAs). Both are safe ways to grow your money, both are usually insured by the FDIC or NCUA, and both help you earn more than keeping money in a regular checking account. But which one is better for you? That’s what this article will explain in detail.

In this ultimate guide, we’ll break down the differences between CDs and HYSAs, explain how they work, compare their pros and cons, and help you decide which option fits your financial goals. By the end of this article, you’ll have complete clarity on CD vs HYSA and know how to make the smartest choice for your money.

What is a CD?

A Certificate of Deposit (CD) is a savings product offered by banks and credit unions. When you put money in a CD, you agree to leave it untouched for a fixed period of time (called the “term”). In exchange, the bank pays you a higher interest rate compared to a regular savings account.

For example, if you open a 12-month CD with a 5% interest rate and deposit $5,000, you cannot withdraw that money until the 12 months are over (without penalty). At the end of the term, you get your $5,000 back plus the interest earned.

- Key Feature: Fixed interest rate for a fixed term

- Common Terms: 3 months, 6 months, 1 year, 5 years

- Downside: Limited access to your money until maturity

What is a HYSA?

A High-Yield Savings Account (HYSA) is a savings account that pays much higher interest than a regular savings account. These accounts are usually offered by online banks because they have lower overhead costs, allowing them to pass on better rates to customers.

For example, a traditional savings account may offer only 0.01% APY, while an HYSA can offer 4% or more, depending on market conditions.

- Key Feature: High interest rates, usually variable

- Liquidity: You can withdraw anytime without penalty

- Best Use: Emergency funds, flexible savings, short-term goals

How Do CDs and HYSAs Work?

Both CDs and HYSAs are savings tools, but they work differently:

- CDs: Lock your money for a set time. You earn a fixed interest rate no matter what happens in the market. But, if you withdraw early, you usually pay a penalty.

- HYSAs: Keep your money liquid. Interest rates can change over time, depending on the Federal Reserve and banking market trends. You can withdraw anytime, making them flexible.

In short, CDs are like a fixed contract, while HYSAs are like a flexible savings option with changing interest rates.

Interest Rates: CD vs HYSA

One of the most important factors in choosing between a CD and an HYSA is the interest rate.

- CDs: Usually offer higher fixed rates if you commit for longer terms. For example, a 5-year CD may offer more than a 1-year CD.

- HYSAs: Offer competitive rates that move up or down with the market. This means your earnings may change over time.

Example: If an HYSA offers 4.5% APY and a 1-year CD offers 5.0% APY, the difference may not be huge. But if rates rise, your HYSA might go up, while your CD stays locked at 5.0%.

Liquidity and Accessibility

Liquidity means how easily you can access your money. Here is how CDs and HYSAs compare:

- CDs: Very low liquidity. Once you deposit money, you cannot touch it until the CD matures. If you withdraw early, the bank will charge a penalty, often equal to several months of interest. Some CDs may not allow early withdrawals at all.

- HYSAs: Very high liquidity. You can deposit or withdraw money at any time without penalties. Most online banks let you transfer money electronically between your HYSA and checking account within 1–3 business days.

If you think you might need your money quickly for emergencies, an HYSA is the safer option. If you know you won’t touch the money for a fixed period, a CD could earn you more.

Risk and Safety

Both CDs and HYSAs are considered very safe savings options because they are usually FDIC-insured (for banks) or NCUA-insured (for credit unions). This means your money is protected up to $250,000 per depositor, per institution.

- CDs: No market risk, fixed interest rate, guaranteed returns if held to maturity.

- HYSAs: No market risk, but the interest rate can change. If rates fall, you may earn less in the future.

In summary, both are safe, but CDs give certainty while HYSAs give flexibility.

Pros and Cons of CDs

Like every financial product, CDs come with advantages and disadvantages.

Pros of CDs

- Fixed Returns: Your interest rate is locked in for the term. Market changes won’t affect you.

- Higher Rates for Longer Terms: The longer you commit, the better rates you often get.

- Safe and Insured: FDIC/NCUA insurance protects your money up to $250,000.

- Good for Discipline: Since your money is locked, you won’t be tempted to spend it.

Cons of CDs

- No Flexibility: Your money is locked until maturity.

- Early Withdrawal Penalty: Taking money out early means losing interest or paying penalties.

- Missed Opportunities: If interest rates rise, you’re stuck with the lower rate.

- Not Ideal for Emergencies: Because your money is tied up, it’s not useful for sudden needs.

Pros and Cons of HYSAs

Now let’s look at the advantages and disadvantages of High-Yield Savings Accounts.

Pros of HYSAs

- Easy Access: Withdraw your money anytime without penalty.

- High Interest: Earn much more compared to traditional savings accounts.

- Safe and Insured: Just like CDs, your money is FDIC/NCUA insured.

- Flexible for Goals: Great for emergency funds, vacation savings, or any short-term target.

- Rates Can Increase: If the Federal Reserve raises rates, your HYSA rate may go up too.

Cons of HYSAs

- Variable Interest: Rates can drop anytime if the market changes.

- Transfer Delays: Moving money to a checking account may take 1–3 days, not instant in most cases.

- Online-Only Banks: Many HYSAs are offered by online banks, which may not suit people who prefer in-person banking.

- Rate Competition: Banks frequently change rates, so you may need to switch accounts to stay competitive.

Which Is Better for Short-Term Savings?

If your savings goal is short-term, like planning a vacation in six months or building an emergency fund, an HYSA is the better choice. The main reason is flexibility. You can withdraw the money anytime without paying a penalty.

Example: Suppose you save $3,000 in an HYSA for your vacation. If something unexpected happens and you need to use $1,000 for car repairs, you can do so easily without losing interest or paying a penalty. With a CD, this would not be possible without a penalty.

- Best Use: Emergency funds, vacations, upcoming bills, or saving for a short-term purchase.

- Main Advantage: Liquidity and safety with a competitive interest rate.

Which Is Better for Long-Term Savings?

If your goal is long-term, such as saving for a house in five years or for a child’s education, a CD can sometimes be the better choice. With a CD, you lock in a rate, and even if market rates drop, your returns remain the same.

Example: If you deposit $20,000 in a 5-year CD at 5% APY, you know exactly how much you’ll earn in five years. That stability can help with planning. An HYSA, on the other hand, could see its rate drop to 2% or less if the Federal Reserve cuts rates, lowering your earnings.

- Best Use: House down payment, wedding savings, or medium to long-term goals.

- Main Advantage: Guaranteed return and protection against falling interest rates.

Tax Implications of CDs vs HYSAs

Both CDs and HYSAs are subject to taxes on the interest you earn. The IRS treats this interest as ordinary income, meaning it’s taxed at your regular income tax rate.

- CDs: Interest is taxed in the year it is earned, even if you don’t withdraw it until maturity.

- HYSAs: Interest is taxed each year when it is credited to your account.

Important Tip: If you are in a high tax bracket, your after-tax returns may be lower. In such cases, you might also want to consider other tax-advantaged savings options like IRAs or 529 plans, depending on your goals.

Best Situations for Choosing a CD

CDs work best when:

- You don’t need access to your money for the term of the CD.

- You want a guaranteed fixed return.

- You expect interest rates to fall soon.

- You are saving for a specific long-term goal with a fixed timeline.

Example: Saving for a wedding two years away? A 24-month CD could be a smart option because you know you won’t touch the money until then.

Best Situations for Choosing a HYSA

HYSAs are better when:

- You want quick access to your money.

- You are building or maintaining an emergency fund.

- You expect interest rates to rise and want the flexibility to benefit.

- You are saving for short-term or flexible goals.

Example: If you are saving $10,000 as a cushion for emergencies, keeping it in an HYSA makes sense. You can withdraw instantly if needed, and your money earns more than a traditional savings account.

How to Open a CD or HYSA

Opening a CD or HYSA is simple, but the process may vary depending on the bank or credit union. Here’s a step-by-step breakdown for each.

Steps to Open a CD

- Choose a Bank or Credit Union: Compare CD rates across multiple institutions. Online banks often offer higher rates than traditional banks.

- Select the Term: Decide how long you can commit your money—3 months, 6 months, 1 year, 5 years, etc.

- Deposit Money: Fund your CD with the minimum required amount, which could range from $500 to $5,000 depending on the institution.

- Wait for Maturity: Keep your money in until the CD matures. At maturity, you can withdraw your money plus interest, or roll it into a new CD.

Steps to Open a HYSA

- Research Banks: Compare HYSA rates. Online banks usually provide the best offers.

- Apply Online: Most HYSAs can be opened online with just your personal details and identification.

- Link to Checking Account: You’ll need to connect a checking account to transfer funds in and out.

- Deposit Funds: Fund your account to start earning interest immediately. There’s usually no long-term commitment.

Pro Tip: Always confirm that the bank is FDIC- or NCUA-insured before opening a CD or HYSA. This ensures your money is safe.

Tips for Maximizing Returns

Whether you choose a CD or an HYSA, here are some smart strategies to earn the most from your savings:

- Shop Around: Don’t settle for the first bank you find. Rates vary widely, so compare multiple options.

- Use CD Laddering: Instead of putting all your money in one long-term CD, divide it into multiple CDs with different maturity dates. This gives you regular access to funds and flexibility to reinvest if rates rise.

- Take Advantage of Online Banks: Online-only institutions typically offer the highest CD and HYSA rates because they have lower operating costs.

- Check for Promotions: Some banks offer special promotional CDs or sign-up bonuses for opening HYSAs. These can boost your returns.

- Reinvest Wisely: When a CD matures, don’t automatically roll it over. Compare current rates to see if there’s a better option available.

Example: If you have $10,000 to invest, you could put $2,000 each into 1-year, 2-year, 3-year, 4-year, and 5-year CDs. Every year, one CD matures, giving you cash access while keeping the rest locked at competitive rates.

Common Mistakes to Avoid

Many savers lose out on potential returns or get stuck with penalties because of simple mistakes. Here are the most common ones:

- Locking Money You Need: Putting emergency funds into a CD can backfire if you need quick access. Always keep emergency money in an HYSA instead.

- Ignoring Penalties: Withdrawing early from a CD usually costs several months of interest. Never open a CD unless you’re sure you won’t need the money until maturity.

- Forgetting About Maturity: Some banks automatically roll over your CD when it matures. If you forget to withdraw or move the funds, you could be stuck in another term with a lower rate.

- Chasing Only the Highest Rate: The highest advertised rate might come with conditions, like higher deposit minimums. Always read the fine print.

- Not Checking Rate Changes in HYSAs: HYSA rates can drop anytime. If your bank lowers rates significantly, consider moving your money to a better-paying account.

Bottom Line: Avoid these mistakes by planning your savings carefully and staying informed about your bank’s policies.

CD vs HYSA for Emergency Funds

When building an emergency fund, the number one priority is accessibility. An emergency fund is meant to cover unexpected expenses like medical bills, car repairs, or job loss. For this reason, an HYSA is usually the better option compared to a CD.

- HYSA for Emergencies: Since you can withdraw money anytime without penalties, an HYSA gives you both safety and flexibility. Your funds remain liquid, while still earning interest.

- CD for Emergencies: Not ideal. If an emergency occurs and your money is locked in a CD, you’ll face early withdrawal penalties. That could cost you part of your savings right when you need it most.

Conclusion: Always keep emergency funds in a High-Yield Savings Account, not a CD. CDs can be used for extra savings, but not for money you may need on short notice.

CD Laddering Strategy Explained

A popular way to balance flexibility and higher returns with CDs is the laddering strategy. This method helps you avoid locking all your money at once, while still benefiting from longer-term CD rates.

What is CD Laddering?

Instead of putting all your money into a single CD, you spread it across multiple CDs with different maturity dates. As each CD matures, you can either use the money or reinvest in a new long-term CD.

How CD Laddering Works (Example)

Imagine you have $10,000 to invest. Instead of putting the full $10,000 into a 5-year CD, you could create a ladder like this:

- $2,000 in a 1-year CD

- $2,000 in a 2-year CD

- $2,000 in a 3-year CD

- $2,000 in a 4-year CD

- $2,000 in a 5-year CD

When the 1-year CD matures, you can reinvest that $2,000 into a new 5-year CD. The next year, the 2-year CD matures, and you do the same. Eventually, you’ll have a ladder where one CD matures every year, giving you both regular access to cash and long-term high rates.

Benefits of CD Laddering

- Flexibility: You’re never more than a year away from a CD maturing.

- Higher Returns: Most of your money benefits from longer-term rates.

- Reduced Risk: If rates rise, you’ll have opportunities to reinvest at higher rates.

Pro Tip: CD laddering is perfect for savers who want higher returns than an HYSA but still need periodic access to money.

HYSA and Online Banks

One of the main reasons HYSAs have become popular in recent years is the rise of online banks. Unlike traditional brick-and-mortar banks, online banks have lower costs, so they pass the savings to customers through higher interest rates.

Why Online HYSAs Often Pay More

- No Physical Branches: Online banks don’t pay for expensive branch networks.

- Lower Overheads: Savings from reduced staff and property costs allow them to offer higher APYs.

- Tech-Driven: Online systems make account management simple, quick, and low-cost.

Advantages of Online HYSAs

- Higher Rates: Many online banks offer 4%–5% APY or more, while traditional banks may pay less than 0.10%.

- Easy Transfers: Link your checking account and move funds in or out in just a few clicks.

- FDIC/NCUA Insurance: Even though they’re online, they’re just as safe as traditional banks if FDIC- or NCUA-insured.

Things to Watch Out For

- Transfer Delays: Moving money to your checking account may take 1–3 business days.

- No Cash Deposits: Most online banks don’t allow direct cash deposits.

- Digital-Only Service: If you prefer face-to-face customer service, online banks may feel limited.

Conclusion: For most savers, online HYSAs are a great way to maximize returns while keeping full liquidity.

Final Verdict: CD vs HYSA

Both Certificates of Deposit (CDs) and High-Yield Savings Accounts (HYSAs) are excellent tools for safe savings. However, the best choice depends on your financial goals, timeline, and need for flexibility.

When a CD is Better

- You want a guaranteed fixed return.

- You are saving for a long-term goal with a clear timeline.

- You don’t need access to the money before maturity.

- You believe interest rates might fall and want to lock in today’s higher rates.

When an HYSA is Better

- You want quick and easy access to your money.

- You are building or maintaining an emergency fund.

- You are saving for short-term goals like vacations or home repairs.

- You want flexibility to take advantage of rising interest rates.

Bottom Line: Use an HYSA for liquidity and emergencies, and CDs for fixed long-term goals where you can lock away your money without worry.

Decision-Making Guide

If you’re still unsure, here’s a simple way to decide:

- Step 1: Ask yourself if you need access to the money in the next 12 months. If yes, choose a HYSA.

- Step 2: If you don’t need access and are comfortable locking it away, consider a CD.

- Step 3: For a balanced approach, use both. Keep emergency funds in an HYSA and invest surplus in CDs or a CD ladder.

This way, you enjoy both liquidity and higher returns, depending on your needs.

FAQs About CD vs HYSA

1. Is a CD safer than an HYSA?

Both are equally safe as long as they are FDIC- or NCUA-insured. The main difference is that CDs lock your money, while HYSAs keep it flexible.

2. Can I lose money in a CD or HYSA?

No, you won’t lose your principal as long as the account is FDIC- or NCUA-insured. The only risk with CDs is losing some interest if you withdraw early.

3. Which earns more, a CD or an HYSA?

It depends on interest rates. CDs often pay slightly more if you commit for a longer term. HYSAs can match or beat CDs when rates rise, but they can also drop if rates fall.

4. Can I open both a CD and an HYSA?

Yes. In fact, many smart savers do both. Keep your emergency fund in an HYSA and use CDs for extra money you don’t need right away.

5. Do CDs or HYSAs have fees?

Most don’t have monthly fees. But CDs have penalties for early withdrawals. Always read the terms before opening.

6. Are HYSA interest rates guaranteed?

No. HYSA rates are variable and can change based on market conditions. CDs, however, lock in your rate for the full term.

7. Can I use a CD or HYSA for retirement savings?

Not directly. CDs and HYSAs are good for safe cash storage, but for retirement, tax-advantaged accounts like IRAs and 401(k)s usually provide better long-term growth.

Conclusion

When it comes to CD vs HYSA, there is no one-size-fits-all answer. Both have unique advantages:

- CDs: Perfect for long-term, disciplined saving with guaranteed returns.

- HYSAs: Best for short-term goals, emergency funds, and flexible savings with easy access.

The smartest strategy for most people is a combination of both. Keep your emergency fund in an HYSA so it’s always accessible. Then, put any extra savings you won’t need immediately into CDs to earn higher guaranteed returns.

By balancing liquidity and returns, you can make your money work harder for you while still keeping it safe. Whether you choose a CD, an HYSA, or both, the key is to start saving today and let time grow your money.

Key Takeaways: CD vs HYSA

- HYSAs are flexible and liquid—ideal for emergency funds.

- CDs offer fixed returns but lock your money until maturity.

- Both are FDIC/NCUA insured and considered safe investments.

- The best choice depends on your goals and time horizon.

Final Word: For flexibility, choose an HYSA. For guaranteed returns, choose a CD. For the best of both worlds, use a mix of the two.

FAQ:-

How much will a $10,000 CD make in a year?

The earnings from a $10,000 CD depend on the annual percentage yield (APY) offered by the bank. For example, at 4% APY, a $10,000 CD would earn about $400 in one year. If the APY is lower, say 3%, it would make around $300 annually. Always check the current rate before opening a CD.

What if I put $20,000 in a CD for 5 years?

If you place $20,000 in a CD with a fixed 4% APY for 5 years, you could earn about $4,000 in interest, making the total around $24,000 at maturity. Higher or lower rates will change the final amount. CDs lock in your money, so you cannot withdraw without penalty until the term ends.

How much would $100,000 make in a high-yield savings account?

The earnings depend on the bank’s APY. For example:At 3.5% APY, $100,000 would earn about $3,500 per year.At 5% APY, it could make around $5,000 annually.Since HYSA rates are variable, the actual earnings may change over time, but they remain higher than traditional savings accounts.

Why is CD not a good financial investment?

CDs are safe but not always the best investment because:

Low flexibility: Money is locked in until maturity.

Penalty for early withdrawal: Taking money out early reduces interest earned.

Lower returns compared to other investments: Stocks, bonds, or even high-yield savings may offer better long-term growth.

That said, CDs are still useful for people who want guaranteed, risk-free savings with fixed interest.