In today’s fast-changing financial world, choosing the right savings option can make a big difference in your earnings. A High-Yield Savings Account (HYSA) is one of the most popular and safe ways to grow your money in 2025. Unlike regular savings accounts, HYSAs offer higher interest rates, giving your balance the power to grow faster while still being secure.

What is a HYSA?

A High-Yield Savings Account is a type of savings account offered by banks and credit unions that pays a much higher annual percentage yield (APY) compared to traditional accounts. These accounts are federally insured (up to $250,000 by FDIC or NCUA), making them both profitable and safe.

Why Choose a HYSA in 2025?

With inflation and rising living costs, it’s important to maximize your savings. A HYSA helps you:

Earn higher interest on idle cash

Keep money safe with FDIC/NCUA insurance

Maintain flexibility since funds are easily accessible

Avoid high risk compared to stock market investments

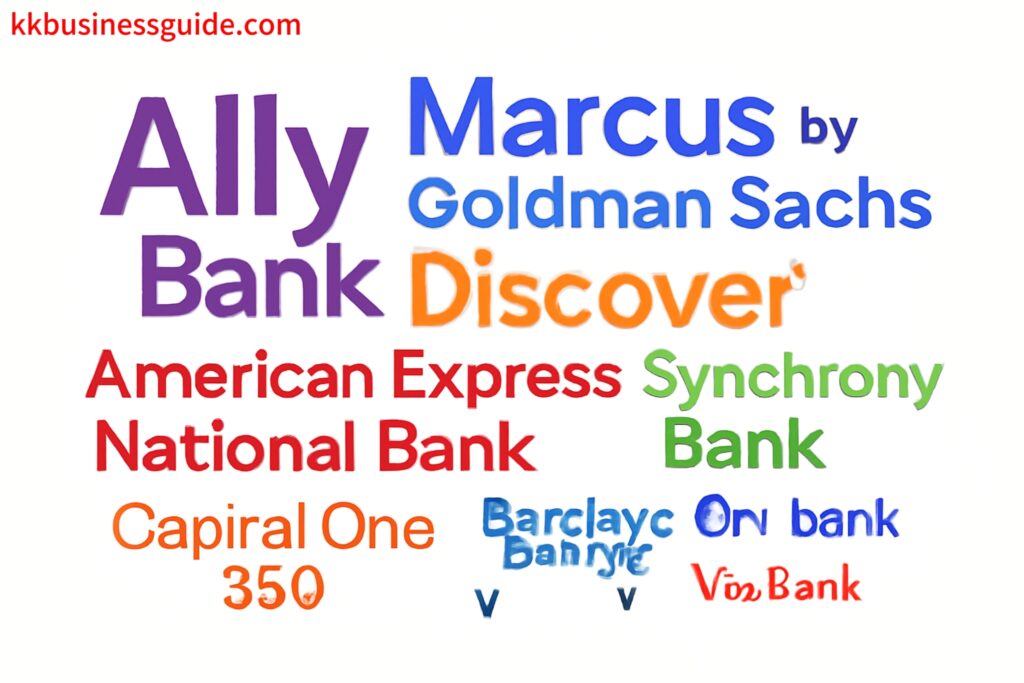

Best HYSA Options in the USA – 2025

Here are some of the top-performing HYSAs you can consider this year:

1. Online Banks

Many online banks are leading the way in offering competitive APYs. With lower overhead costs, they pass more value to customers. In 2025, APYs are averaging between 4.25% – 5.00% depending on the bank.

Top Online Banks Offering HYSA in 2025

1. Varo Bank – High-Yield Savings

APY: 5.00%

Minimum Balance: $0

Why Choose: No fees, mobile-first, easy to use. Perfect for tech-savvy savers.

—

2. AdelFi – New Member Money Market Savings

APY: 5.00%

Minimum Balance: $25

Why Choose: Great option for new members; ideal for those comfortable with credit union banking.

—

3. Fitness Bank – Ultra Savings

APY: 5.00%

Minimum Balance: $100

Why Choose: Unique “fitness-based” perks; encourages a healthy lifestyle while saving.

—

4. Axos Bank – ONE Savings

APY: ~4.66%

Minimum Balance: $1,500 or qualifying deposits

Why Choose: No monthly fees and higher rates for active users.

—

5. Openbank (by Santander) – High-Yield Savings

APY: ~4.40%

Minimum Balance: $500 opening deposit

Why Choose: Reliable global brand with a modern digital platform.

—

6. LendingClub – LevelUp Savings

APY: Up to ~4.40%

Minimum Balance: $0

Why Choose: Competitive rates for those who maintain deposits regularly.

—

7. EverBank – Performance Savings

APY: ~4.30%

Minimum Balance: $0

Why Choose: No fees, simple to use, and backed by a trusted financial institution.

—

8. BrioDirect – High-Yield Savings

APY: ~4.35%

Minimum Balance: $5,000

Why Choose: Ideal for savers with higher balances seeking strong returns.

—

9. CIT Bank – Platinum Savings

APY: ~4.10–4.55%

Minimum Balance: $5,000 (for highest rate)

Why Choose: Flexible account with tiered interest rates.

—

10. SoFi – Checking & Savings

APY: Up to ~5.30% (with direct deposit)

Minimum Balance: $0

Whey Choose: All-in-one banking with cash-back perks and early paycheck access.

—

11. Ally Bank – Online Savings

APY: ~3.5–4.40%

Minimum Balance: $0

Why Choose: Excellent budgeting tools like “Buckets” and trusted 24/7 support.

—

12. Marcus by Goldman Sachs – Online Savings

Apy: ~4.10–4.40%

Minimum Balance: $0

Why Choose: Reliable bank with fast transfers and no fees.

—

13. Synchrony Bank – High-Yield Savings

APY: ~4.75%

Minimum Balance: $0

Why Choose: High APY plus an optional ATM card for easy cash access.

—

14. Discover Bank – Online Savings

Apy: ~4.30–4.35%

Minimum Balance: $0

Why Choose: User-friendly app, strong customer service, and no monthly fees.

—

15. Bread Savings (Comenity Direct)

APY: ~4.75%

Minimum Balance: $100 opening deposit

Why Choose: Strong returns with no fees; quick transfers.

—

16. Popular Direct – Select Savings

APY: ~4.76%

Minimum Balance: $100

Why Choose: Among the highest yields in 2025, suitable for long-term savers..

17. American Express – High-Yield Savings Account (HYSA)

APY: ~4.25%

Minimum Balance: $0

Why Choose: A trusted global financial brand offering a simple, fully online savings account. No monthly fees, FDIC insured, and easy account management through a clean digital platform.

READ MORE:- AMEX HYSA REVIEW

2. Credit Unions

Certain credit unions are also offering attractive savings rates to members. They often provide extra perks like low fees and community-focused services.

3. Traditional Banks with Digital Accounts

Some large banks have launched digital-only savings products to compete with online banks. These often combine the trust of a well-known institution with higher yields.

Factors to Compare Before Opening a HYSA

Before choosing a HYSA in 2025, consider the following points:

1.APY (Annual Percentage Yield): Higher is better.

2. Minimum Balance Requirement: Some accounts require no minimum, while others may.

3.Fees: Look for accounts with no maintenance or hidden fees.

4.Accessibility: Check if mobile apps, ATMs, and transfers are convenient.

5.Promotions or Bonuses: Some banks offer cash bonuses for new accounts.

credit- alice cee

Conclusion

A High-Yield Savings Account is one of the smartest financial tools in 2025 for anyone in the USA who wants safety plus growth. With interest rates staying strong, it’s the perfect time to review your options and move your savings into a HYSA that works for you.

Whether you are saving for an emergency fund, a home down payment, or simply want your money to work harder, the best HYSA in 2025 can help you reach your goals faster.

2 thoughts on “Best High-Yield Savings Accounts (HYSA) in the USA for 2025”